Land Real Estate

Investment

Investing in Land Real Estate

When investing in commercial real estate we believe that increasing corporate investment in research and development, combined with a reshoring of U.S. manufacturing and supply chains, will drive attractive demand fundamentals for the Technology and Land Real Estate asset classes over the next 5 to 10 years.

Our fundamentals-based investment process capitalizes on opportunities in the commercial real estate sector with the specific objectives to:

- Preserve investor capital

- Make regular cash distributions

- Realize capital appreciation, and provide liquidity through repurchase agreements

Commercial Property Investing Sector Fundamentals

Some of the commercial property investing includes e-commerce, reshoring and R&D.

E-commerce

As consumer demand for online shopping keeps growing*, e-commerce will continue to drive demand for industrial properties (and specifically distribution and logistics spaces).

Reshoring

U.S. companies will continue to seek to move operations to domestic locations to maintain greater control and oversight of their supply chains.

R&D

Over the past ten years, the industrial flex asset class has grown significantly due to increased tenant demand. R&D facilities represent the 3rd largest category of Commercial Real Estate and have seen a 288% increase in occupancy in the last ten years.

- Industrial and technology companies utilize R&D/flex facilities to develop, test and improve new and existing products and services. Corporations in these sectors prefer R&D/flex facilities as they offer the ability to house multiple space types within one facility, which can offer these corporations efficiency and cost savings.

- From Q1 2010 to Q1 2020, the total square footage of R&D/flex space increased from 44M square feet to 171M square feet, while flex transaction volume increased from $3.4B to $24.6B.**

*Rakuten Intelligence, U.S. e-commerce sales rose 24% from March 1-17, 2020

**Real Capital Analytics

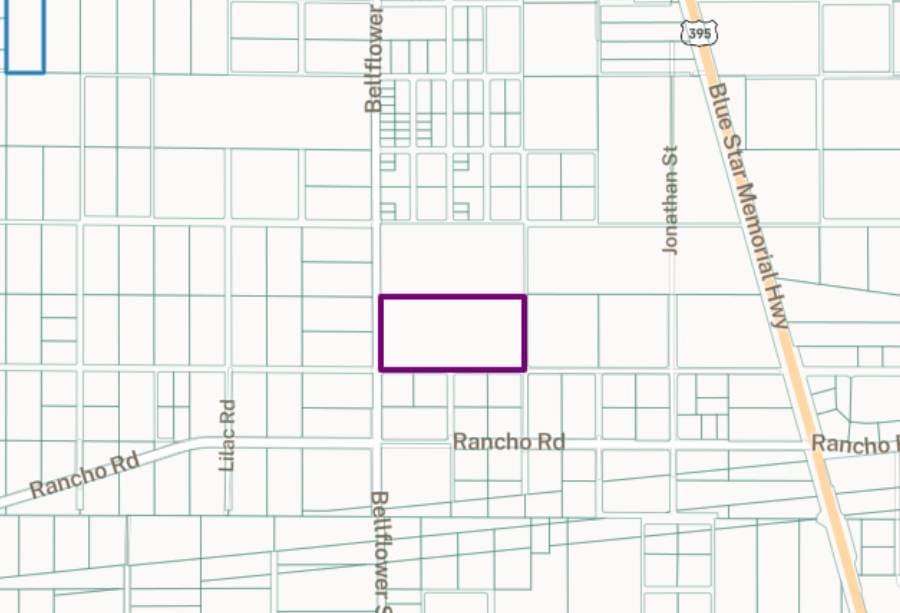

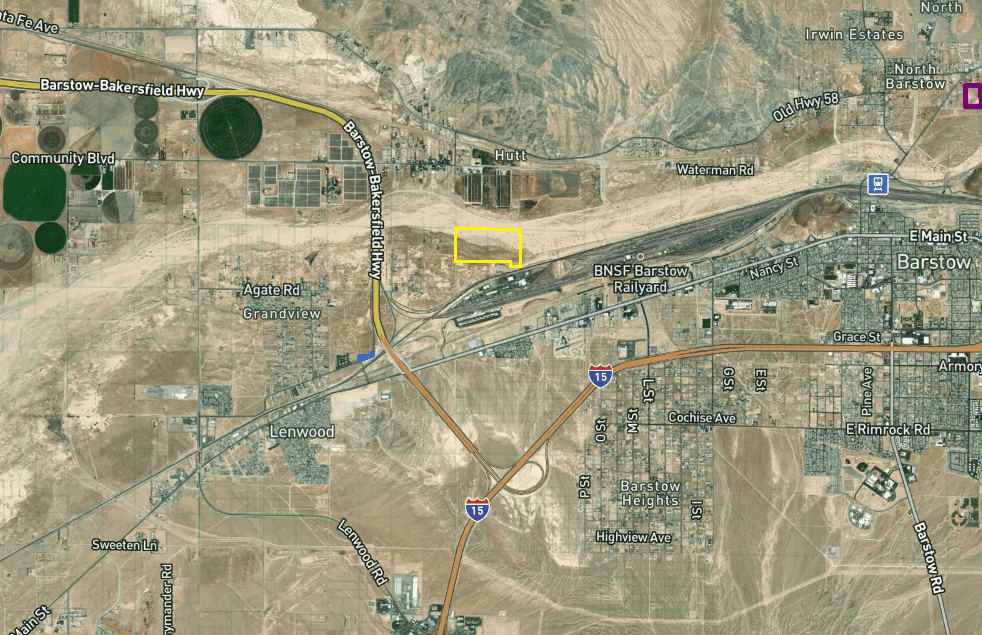

Target Properties

TECHNOLOGY SPACES

Given the highly digitized nature of modern commerce, most companies require some degree of data storage that requires specific facilities to house the storage equipment, run IT systems, and facilitate cloud storage and computing, including climate control and security protocols.

INDUSTRIAL SPACES

How We Invest

Macro View

We take into account demographics, local economy, Government policies/subsidies, structural regional trends, and long-term trends in real estate improvement.

End-Market Analysis

We dive deep into the end markets for future development product we target to determine how long-term trends in the industry may influence end prices.

Property Analysis

We incorporate 150 data sets from public, private and proprietary data sources when analyzing properties. We also apply our proprietary technology to zero in on the best opportunities.

Due Diligence

Our 105-point due diligence checklist includes zoning, utilities connection, transportation infrastructure, capital improvements, title, local legislation, cost of construction, future exit sales, and more.